So, you’re curious about how I manage my investments, especially with a platform like M1 Finance? You’ve come to the right place! Back in 2019, I was deep in the trenches, figuring out my long-term strategy, and M1 played a big role. This post pulls back the curtain on my setup at the time, why I chose M1, and the kind of thinking that went into building my portfolio. Whether you’re a seasoned pro, a WallStreetBets enthusiast looking for actual strategies, or an academic curious about practical application, there’s something here for you.

What Exactly IS M1 Finance?

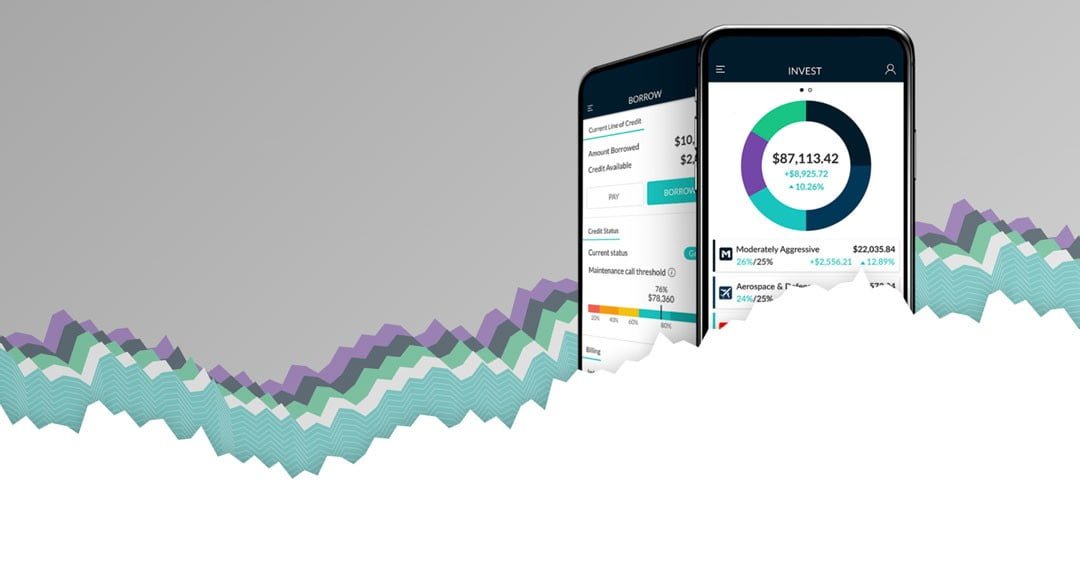

For the uninitiated, M1 Finance (“M1”) is a pretty slick investment brokerage. What makes it stand out? It’s famous for helping folks like us implement asset allocation strategies using “investment pies.” Imagine building your dream portfolio like a custom pizza – a slice for ETFs, a slice for your favorite tech stocks, another for dividend champs. M1 makes that visual and automated. And yes, like Robinhood or Webull, they offer commission-free trading, which is a huge plus for keeping costs down. (P.S. Those are my referral links – if you sign up, you might get a bonus, and so might I!)

My (Slightly Wild) Trading History: The Road to M1

My investment journey didn’t start with perfectly balanced pies. Oh no. Back in 2016, I jumped in with Robinhood and Motif. They were great for getting my feet wet. I was day trading on my lunch breaks, swing trading, trying to play earnings roulette… you know the drill. It didn’t take long to realize that trading on pure emotion and gut feelings was a fast track to watching my hard-earned cash evaporate. Thousands of dollars could vanish in seconds – a tough lesson, but a valuable one!

That’s when I knew I had to get serious and educate myself. I needed systematic methods, not just hopeful punts. I explored a bunch of platforms: Stash, Acorn (for those spare change round-ups), Prosper (peer-to-peer lending), Betterment (robo-advisor), high-yield savings accounts, and eventually, M1. To tame my emotional trading and stop those heart-stopping losses, M1 Finance, with its focus on pre-set allocations and automated investing, became my go-to for the core of my strategy.

My Brain Food: Essential Finance Reads

Education was, and still is, key. As part of my Master’s, I even took a Financial Engineering course which was fascinating. Over the years, my bookshelf started groaning under the weight of finance books. Here are some that really shaped my thinking back then. These are linked to the cheapest versions on Amazon (and are still classics):

- The Intelligent Investor by Ben Graham (The Bible of value investing!)

- Common Stocks and Uncommon Profits by Philip Fisher (All about finding those growth gems)

- Irrational Exuberance by Robert Shiller (Understanding market bubbles)

- Principles by Ray Dalio (Life and work wisdom from a hedge fund titan)

- The Little Book of Common Sense Investing by John C. Bogle (Why index funds rock)

- Stock Investing for Dummies (Hey, we all start somewhere!)

- The Richest Man in Babylon (Timeless lessons on wealth)

- One Up On Wall Street by Peter Lynch (Invest in what you know)

This is just a taste! My quest for knowledge is relentless. If you’re serious about this stuff, continuous learning is non-negotiable.

My 2019 M1 Finance Portfolio: A Snapshot

Disclaimer: I’m not your financial advisor, and this portfolio was specific to my views and goals *in September 2019*. My actual holdings change based on market rotations, where we are in the business cycle, what the Shiller P/E ratio is screaming, interest rate moods, and maybe even if a certain former President was on vacation (just kidding… mostly!). Things change fast, so always do your own research!

Back then, my M1 portfolio was split into two main strategies: a diversified “Overall Funds” pie and a more targeted “Specific Stocks” pie. Here’s what it looked like:

Yeah, I know, some folks (including my past self sometimes) would say that’s a LOT of holdings. The vision was always to refine and focus it over time. If you want to see a more current approach, check out my post on how I navigated the markets during the pandemic.

You can also follow my ongoing journey (and occasional rants) on my YouTube channel, “Engineered Investments”: Engineered Investments on YouTube.

Tools of the Trade (Back Then and Still Relevant!)

Selecting these investments wasn’t random. I leaned heavily on a few key tools (ranked by how much I used them):

- Finviz.com: Absolute beast for filtering stocks. I’d screen for dividends, operating margin, free cash flow, ROI, ROE, P/E, growth rates, P/B, Debt/Equity – you name it. If you’re into fundamental analysis, this is a must. (For a deeper dive on how to use these metrics, see my post on Intrinsic Value [Part 1]).

- Personal Capital (now Empower): Great for analyzing overall portfolio exposure to different markets and sectors. Helped me see the big picture.

- Morningstar.com and Webull: Used these to analyze specific investments against their peers. Webull also has a great app for trading and research – check it out with my referral link for some free stocks!

- Yahoo Finance: Old reliable for quick quotes and news.

- Google Finance Spreadsheets: Leveraging `GOOGLEFINANCE` functions for custom tracking and analysis. If you’re a spreadsheet nerd like me, you’ll love my post on Portfolio Analysis with Google Sheets.

- R-Studio: For the really nerdy stuff! I’d use it to apply data science techniques from my Financial Engineering studies, analyzing stock and options chain data for statistical probabilities.

The “ETFs – Stock And Bonds” Pie (2019)

The goal here was broad diversification with a tilt towards areas I felt were undervalued or offered specific advantages. Here was the target allocation:

International Equities

30%Often undervalued vs. US; diversification

US Equities

25%Core growth engine

US Bonds

10%Portfolio protection, lower volatility

International Bonds

10%Diversification within fixed income

REITs

5%Real estate exposure, diversification, income

Dividend Focus

5%Income generation

Emerging Markets

5%Higher growth potential, undervalued

Small Cap

5%Potential for higher returns (+alpha)

Value

5%Classic +alpha factor, often defensive

This was the aim. My actual M1 pie (screenshot below) would be adjusted over time as I added cash, with M1’s auto-invest feature helping to maintain these target percentages.

A quick rundown of why I picked some of these ETFs back then:

-

VTI

~0.03% ERTotal US stock market exposure – simple, diversified, low cost.

-

VXUS

~0.08% ERAll world ex-US. Broad international diversification.

-

BNDX

~0.08% ERTotal international bond market, currency-hedged for US investors. Stability.

-

BND

~0.035% ERTotal US bond market. Core fixed income holding.

-

IEFA

~0.07% ERDeveloped markets ex-US/Canada. Complements VXUS.

-

VYM

~0.06% ERHigh-dividend US stocks (excluding REITs). For income.

-

SCHD

~0.06% ERFocuses on quality dividend growth stocks using fundamental screens. Solid income and potential growth.

-

VWO

~0.10% EREmerging market exposure. Higher risk, higher potential reward.

-

VNQ

~0.12% ERUS REITs. Real estate diversification and income.

-

VNQI

~0.12% ERInternational REITs. Global real estate exposure.

-

VB

~0.05% ERUS small-cap stocks. Potential for outsized growth.

-

VTV

~0.04% ERUS large-cap value stocks. Often more stable during downturns.

The “Stock Picks by Sector” Pie (2019)

Beyond broad ETFs, I also dedicated a part of my portfolio to individual stock picks, organized by sector. This allowed me to make more concentrated bets on industries I felt had strong tailwinds or specific companies I believed were undervalued or poised for growth. Sector allocation was my way of adding another layer of control and potential alpha.

My target sectors at the time (allocations varied within this pie) included Technology, Healthcare, Consumer Discretionary, Financials, and Industrials. The specific stocks would rotate based on my research using the tools mentioned earlier.

The Big Hairy Audacious Goal (BHAG) from 2019

Back in 2019, my eyes were set on a specific target: earn $6,000/month (in 2019 purchasing power) in dividends by March 15, 2027. Crunching the numbers, assuming about a 15% tax rate and needing a 4.5% portfolio yield, this meant I’d need a principal of around $1.9 million generating that dividend stream. A massive goal, for sure, but having that clarity helped drive my savings and investment decisions.

It’s fun to look back at these old plans and see how things have evolved! The journey is never a straight line.

Want to See the 2019 Portfolio in Action?

Curious about the exact holdings in my M1 “Engineered Pie” as it stood on September 12, 2019? You can check out a snapshot of that pie here: https://m1.finance/a7YAL7S15. (Note: This is an old link for historical context; for current M1 offers, please use my updated referral link: https://m1.finance/CS1v5SJcFDLa where you can get $75 for funding an account!)

One day, all this careful planning, saving, and investing will pay off. The dream? Financial freedom, choices, and maybe, just maybe, a nice view from my home off the coast of Negril, Jamaica.

What did your early investment portfolios look like? Any wild stories or lessons learned? Share them in the comments below!

Trusted Tools & Services

I genuinely use these every day. If you sign up through these links, we both get a win.

Lifestyle & Ridesharing

Finance & Investing

M1 Finance

Get $75 when you sign up and fund a new investment account with $100 or more.

Robinhood

Get fractional shares worth $5-$200 when you sign up and link your bank.

Chase Sapphire Reserve® & Preferred®

Earn 125,000 points with Sapphire Reserve® or 75,000 bonus points with Sapphire Preferred®.

Chase Business Cards

Earn 200,000 bonus points with Sapphire Reserve for Business℠ or up to $1,000 cash back.

Venmo

Both you and your friend earn $5 when they make a qualifying payment of at least $5.

Webull

Join today and get up to 20 free stocks when you fund your account.

Coinbase & Coinbase One

Join Coinbase. Coinbase One members get $10 off next month per referral.

Monarch Money

My favorite tool for tracking all my finances in one place. Try it free for 30 days.

Kalshi

Trade on real-world events. Sign up and we both get $25.