Los Angeles is a city of dreams, but for aspiring homeowners on a budget, the reality of the housing market can be a rude awakening. With a $400,000 budget, options in LA may seem limited. However, by broadening your horizons, you might be surprised by the possibilities available in other cities throughout the country.

This article post explores what $400,000 can buy across the U.S. We’ll look into factors like square footage, local amenities, and the changing dynamic between urban and suburban locations. Understanding these elements will help you visualize your perfect home setting and make the most of your hard-earned investment.

Homeownership and Happiness:

The concept of a “decent home” contributing to happiness dates back to ancient times, with Aristotle’s concern for eudaimonia, often translated as happiness or the good life¹⁴. In modern psychology, positive psychology explores the role of homeownership in well-being. Research shows that a stable and comfortable home environment can significantly contribute to an individual’s sense of security, belonging, and overall well-being¹⁵.

The LA Reality:

Los Angeles is undoubtedly an expensive place to call home. A budget of $400,000 is considered modest and will likely secure a small apartment or condominium in the 500 to 800 square foot range. However, living in LA comes with unique advantages. The city boasts world-class entertainment, a thriving culinary scene, diverse neighborhoods, and a robust job market.

Coastal Comparisons:

Coastal living comes at a premium, with prices in cities like New York and San Francisco mirroring LA’s. In Manhattan, a $400,000 budget might only afford a studio apartment around 267 square feet. In San Francisco, you could expect something slightly larger at around 400 square feet¹. These examples highlight the sacrifice in space often required to live in the heart of these desirable urban hubs.

Midwest & Southern Alternatives:

For those prioritizing space, cities in the Midwest and South offer attractive options. In Detroit, $400,000 could buy a sprawling home with around 5,882 square feet. Cleveland offers a similar value with an average of 5,128 square feet¹. Looking south, cities like Atlanta and Dallas strike a balance, with homes for the same price often ranging from 2,000 to 3,000 square feet¹. These regions provide spacious homes without necessarily trading off proximity to modern amenities or exciting neighborhoods.

The Western Perspective:

If the allure of the West Coast remains, but you want more space than LA provides, consider cities like Phoenix and Denver. A $400,000 budget in these cities typically buys between 1,500 and 2,500 square feet. Homes are often integrated with access to outdoor recreation and vibrant city life¹. While smaller than Midwest or Southern offerings, these cities present a strong mix of livability and location.

Shifting Suburbs:

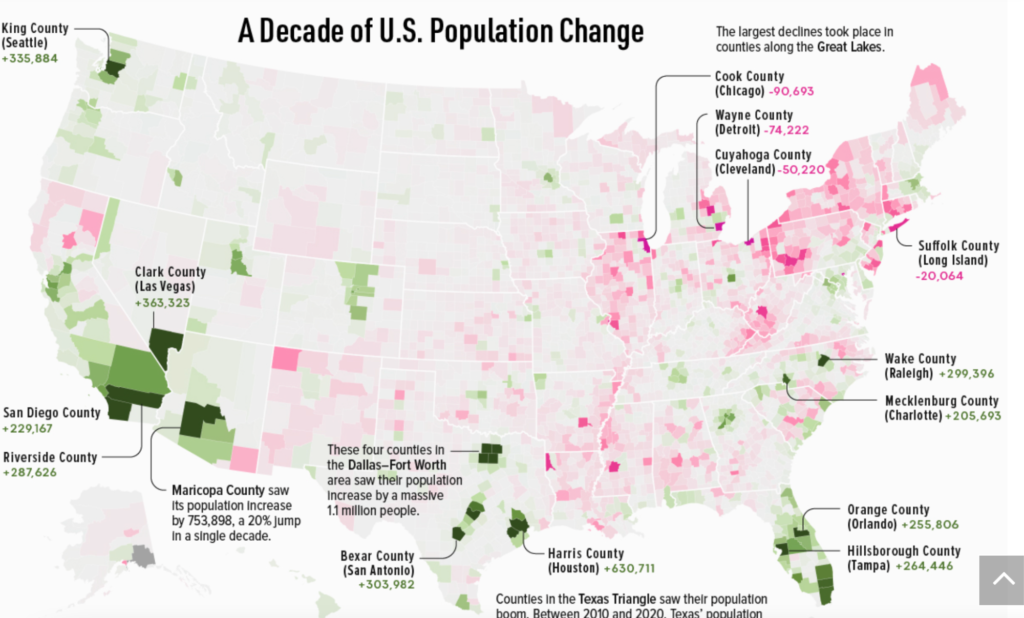

The pandemic significantly impacted housing preferences, with many individuals and families opting for suburban living over the density of urban locations. This shift has fueled increased demand and prices in the suburbs, especially those with a reputation for family-friendly amenities. A Pew Research Center study found that the percentage of Americans willing to live in suburbs rose from 42% in 2018 to 46% in 2022². Before dismissing the suburbs, explore options around LA and compare them to similar communities in other regions.

Current Market Conditions (2024):

The 2024 housing market is in a state of adjustment. After significant price increases over the past few years, prices have declined slightly nationwide due to higher borrowing costs³. However, these changes are not uniform, with regional variations across the country.

In Southern California, for example, the median home sale price remains around $749,900. Major California cities like Los Angeles and San Diego have median prices of $957,000 and $872,500, respectively⁴. New York and Chicago also experience high housing prices, reflecting their economic importance⁵.

Future Market Predictions:

Experts predict slower growth in the housing market, with prices either stabilizing or seeing modest declines. Over the next five years, forecasts suggest low- to mid-single-digit annual appreciation, more in line with historical averages where home prices generally increase slightly above inflation⁶.

Interest Rates and Monthly Payments:

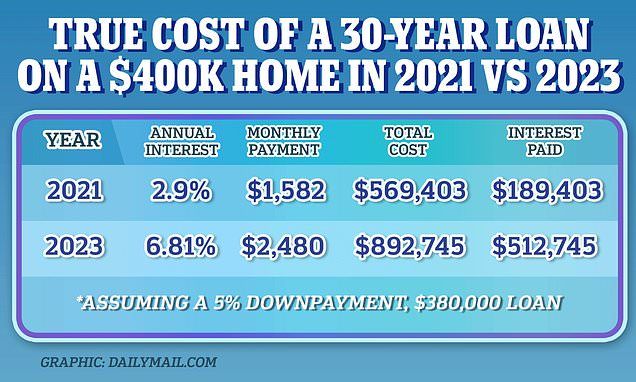

Current mortgage rates hover above 7% for a 30-year fixed mortgage⁷. Though elevated rates are expected through 2024, potential rate cuts by the Federal Reserve could put downward pressure on mortgage rates in the latter half of the year³.

Let’s examine how rates translate into monthly payments at different price points:

- $300,000 Home: 7.5% interest rate = approx. $2,096/month

- $400,000 Home: 7.5% interest rate = approx. $2,795/month

- $500,000 Home: 7.5% interest rate = approx. $3,494/month

These estimates assume a 20% down payment and exclude taxes, insurance, and HOA fees, which can significantly impact the total monthly cost.

Impact on Major Cities:

High living costs and elevated mortgage rates in major job markets like Southern California, New York, and Chicago translate to substantial monthly payments. For instance, a median-priced home in Los Angeles at $957,000 could result in a monthly payment over $6,700, assuming a 20% down payment and a 7.5% interest rate.

Latest Home Buying Statistics:

As of September 2023, the median U.S. home price was $412,000, a 2% increase from the previous year despite fewer homes on the market⁸. California’s median home price reached $787,000, reflecting the state’s ongoing housing supply issues⁹. Texas, known for its affordability, had a median home price of $348,000, making it attractive to many, including Californians seeking lower living costs¹⁰.

Interest Rates and Affordability Over Time:

Mortgage rates have fluctuated significantly over time. The average 30-year fixed rate reached a record low of 2.65% in January 2021 before surging to 7.79% in October 2023¹¹. Despite these fluctuations, the median price for new single-family homes continues to rise, reaching $418,800 as of September 2023¹².

California vs. Texas:

The contrast between California and Texas is stark in terms of home buying. California’s high median home prices result from slow housing production, expensive building codes, and existing residents’ opposition to new housing¹³. Conversely, Texas offers relatively inexpensive housing options, with cities like Austin attracting tech companies and young professionals¹⁰.

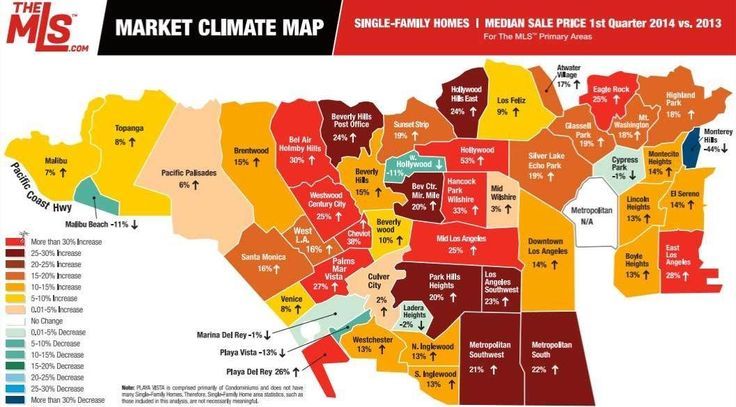

LA County Market Overview:

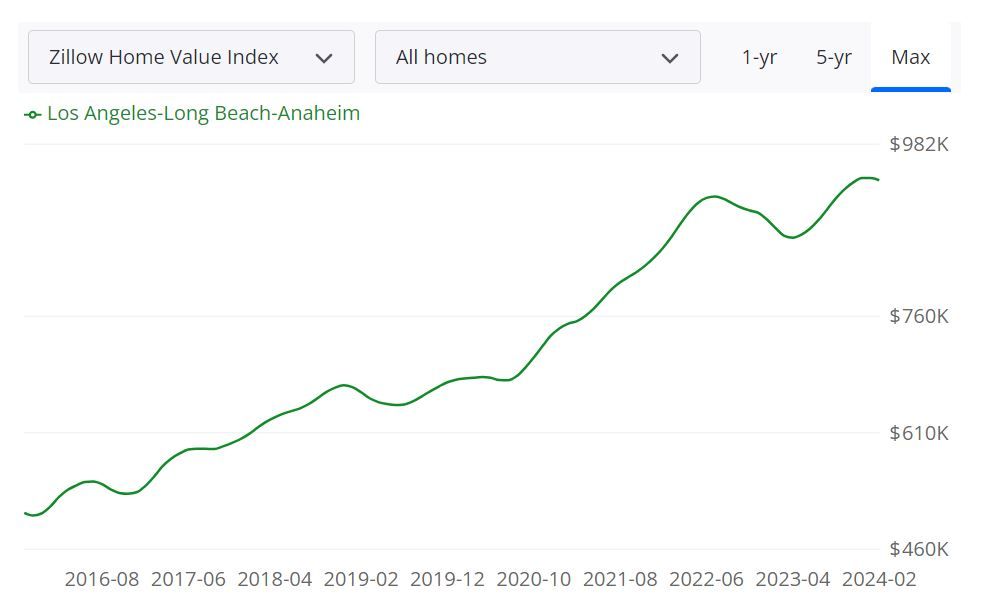

As of early 2024, Los Angeles County’s housing market has shown resilience despite a slight dip in median sold prices. The median sold price for existing single-family homes was $817,100 in February 2024, a 1.9% decrease from January⁴. However, this dip should be viewed within the broader context of consistent growth over the past several years.

Sales Volume and Demand:

Despite the decrease in median sold prices, there was an 8.4% increase in sales volume month-over-month, indicating continued activity and strong demand in the market⁴. Year-over-year data shows a robust 12.4% increase in median sold prices and a 6.3% rise in sales volume, underlining sustained growth⁴.

Regional Perspective:

Looking at the broader Southern California region, the median sold price reached $825,000 in February 2024, marking a 5.0% increase from January. The region also experienced a 14.7% surge in sales volume month-over-month, suggesting heightened market activity⁴.

Housing Supply:

A balanced market typically has a supply of four to six months. In Los Angeles County, inventory levels are calculated monthly by counting the number of active listings and pending sales on the last day of the month. If inventory is rising, there is less pressure for home prices to increase⁴.

Current Trends:

The Los Angeles housing market is somewhat competitive, with homes receiving an average of 3 offers and selling in around 49 days. The median sale price of a home in Los Angeles was $975,000 last month, up 5.9% since last year. The median sale price per square foot is $642, up 4.4% since last year¹⁶.

Migration and Relocation:

There is a notable trend of people moving to Los Angeles from other metros, with 5% of homebuyers searching to move into Los Angeles from outside areas. Conversely, 20% of Los Angeles homebuyers searched to move out of Los Angeles, while 80% looked to stay within the metropolitan area¹⁶.

Conclusion:

While $400,000 may feel limiting in LA, it’s essential to contextualize this budget within the broader national landscape. By exploring what this amount can afford in different cities and regions, you can better assess your priorities and make an informed decision about where to buy. Whether you prioritize location, space, or a blend of both, understanding the market is key to finding your ideal home.

The Los Angeles County housing market continues to demonstrate growth and resilience. While there are fluctuations in prices and sales volume, the overall trend points to a competitive market with strong demand. Buyers and investors should keep a close eye on market trends and inventory levels to make informed decisions in this vibrant market.

Prospective homebuyers in 2024 must navigate a complex landscape of slowly adjusting home prices and relatively high mortgage rates. While the market is showing signs of cooling, affordability remains a challenge, especially in major urban centers where housing demand is driven by job availability. It’s crucial for buyers to carefully consider their budget and consult with financial advisors to understand the long-term implications of their mortgage decisions.

Homeownership remains a key factor in the pursuit of happiness for many Americans. While affordability and interest rates have varied over time, the desire for a decent home that contributes to a fulfilling life remains constant. As you navigate your search, remember that real estate is a dynamic industry, and it pays to stay informed about evolving trends and opportunities.

Bonus!

- Check out techniques for buying your first home in Los Angeles

- See my Rent vs Buy Calculator tip evaluate your specific situation

Sources:

- https://www.thisoldhouse.com/

- https://www.pewresearch.org/short-reads/2020/07/23/are-you-in-the-american-middle-class/

- https://www.bankrate.com/real-estate/housing-market-2024/

- https://investors.firstam.com/investors/overview/default.aspx

- https://www.forbes.com/advisor/mortgages/daily-rates/

- https://www.nerdwallet.com/article/mortgages/2023-home-buyer-report

- https://www.bankrate.com/mortgages/mortgage-rates/

- https://www.nar.realtor/

- https://www.car.org/

- https://www.recenter.tamu.edu/

- https://www.freddiemac.com/pmms

- https://www.census.gov/construction/nrs/index.html

- https://lao.ca.gov/Publications/Report/4509

- https://plato.stanford.edu/entries/aristotle-ethics/

- https://www.apa.org/pubs/journals/releases/ocp-ocp0000059.pdf

- https://www.redfin.com/city/11203/CA/Los-Angeles/housing-market

Trusted Tools & Services

I genuinely use these every day. If you sign up through these links, we both get a win.

Lifestyle & Ridesharing

Finance & Investing

M1 Finance

Get $75 when you sign up and fund a new investment account with $100 or more.

Robinhood

Get fractional shares worth $5-$200 when you sign up and link your bank.

Chase Sapphire Reserve® & Preferred®

Earn 125,000 points with Sapphire Reserve® or 75,000 bonus points with Sapphire Preferred®.

Chase Business Cards

Earn 200,000 bonus points with Sapphire Reserve for Business℠ or up to $1,000 cash back.

Venmo

Both you and your friend earn $5 when they make a qualifying payment of at least $5.

Webull

Join today and get up to 20 free stocks when you fund your account.

Coinbase & Coinbase One

Join Coinbase. Coinbase One members get $10 off next month per referral.

Monarch Money

My favorite tool for tracking all my finances in one place. Try it free for 30 days.

Kalshi

Trade on real-world events. Sign up and we both get $25.