As of 2024, Chicago’s real estate market presents a compelling opportunity for investors, with median home values at $305,596 and median sale prices at $368,000. The market shows steady growth with a 3.8% year-over-year increase in home values and a 5.1% increase in sale prices, making it an attractive destination for both new and experienced real estate investors.

Chicago’s real estate landscape offers something that many major metropolitan areas lack: affordability combined with strong fundamentals. While coastal cities like San Francisco and New York price out many investors, Chicago maintains a sweet spot where cash flow positive properties are still achievable, and appreciation potential remains robust.

Having analyzed real estate markets across the country, Chicago stands out for its diverse neighborhood options, strong rental demand driven by major universities and corporate headquarters, and relatively stable economic foundation. Whether you’re relocating from expensive markets like LA or looking to diversify your investment portfolio beyond your home base, Chicago deserves serious consideration.

Table of Contents

- Market Overview

- Top Neighborhoods for Investment

- Investment Strategies

- Risks and Considerations

- Case Studies

- Financing Your Chicago Investment

- Conclusion and Next Steps

Market Overview: Understanding Chicago’s Investment Landscape

Chicago’s real estate market in 2024 offers a balanced landscape that savvy investors should pay attention to. Unlike the extreme volatility seen in some markets, Chicago demonstrates the kind of steady, predictable growth that builds wealth over time.

Key Market Metrics (2024)

- Median Home Value: $305,596 (+3.8% YoY) – Indicates stable appreciation.

- Median Sale Price: $368,000 (+5.1% YoY) – Shows strong market confidence.

- Median Days on Market: 55 days (No change) – Offers predictable liquidity.

- Sale-to-List Price Ratio: 100.1% (+0.5 points) – Competitive but fair pricing.

- Active Inventory: 7,824 homes (-12%) – Suggests seller’s market conditions.

What makes these numbers particularly interesting is the context. Chicago’s 3.8% appreciation rate significantly outpaces inflation while remaining sustainable. The 55-day average time on market indicates a healthy balance—fast enough to ensure liquidity when you need to sell, but not so fast that it suggests a bubble.

Market Fundamentals That Drive Investment Success

- Employment Diversity: Unlike cities dependent on single industries, Chicago’s economy spans finance, technology, healthcare, and manufacturing.

- Educational Infrastructure: Multiple major universities create consistent rental demand from students and young professionals.

- Transportation Hub: O’Hare and Midway airports, plus extensive rail networks, make Chicago a logistics center.

Strategic Neighborhood Analysis for Maximum Returns

Chicago’s neighborhood diversity is both an opportunity and a challenge. Each area has distinct characteristics that appeal to different investor strategies. Here’s a breakdown of the most promising areas for 2024:

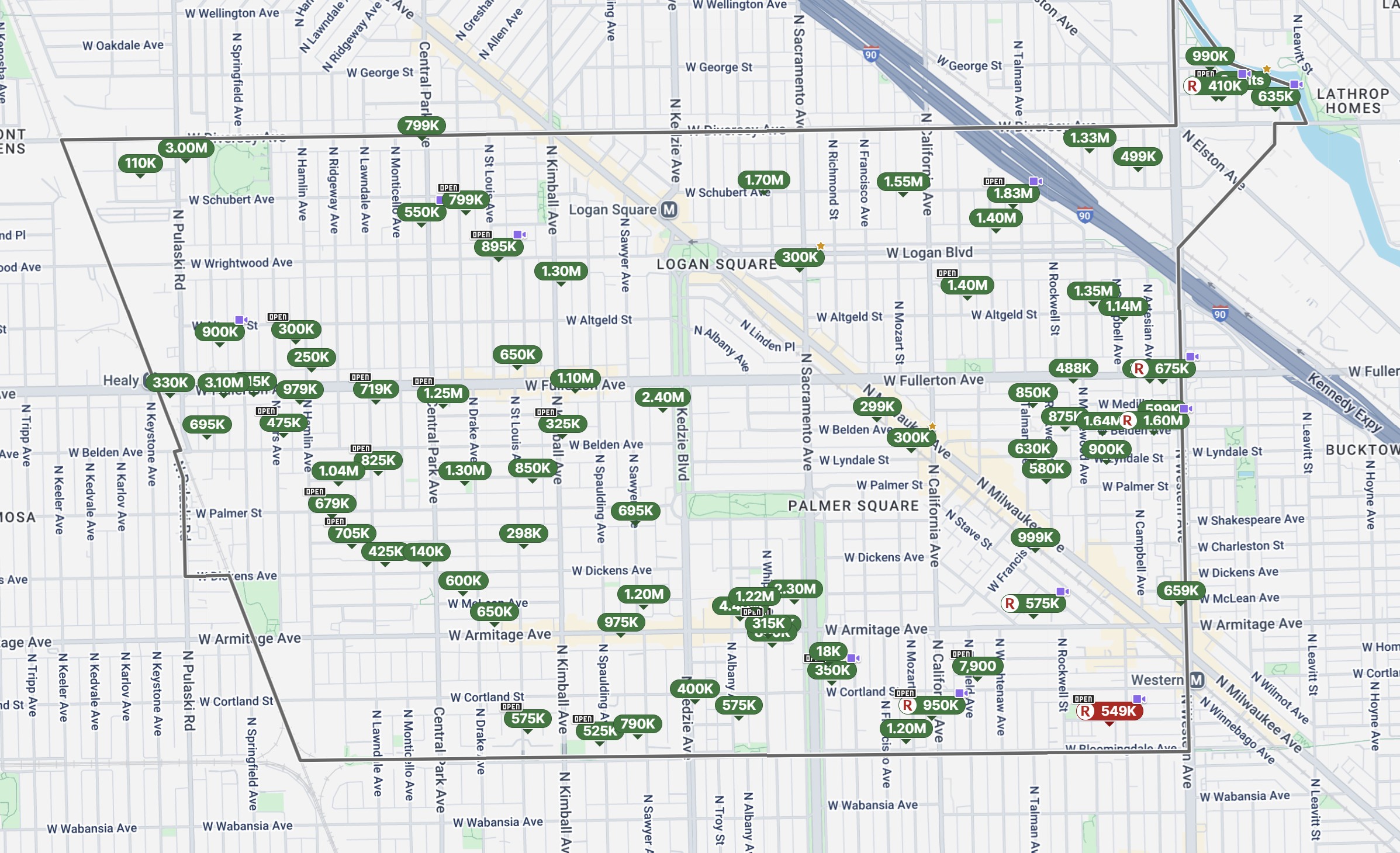

Logan Square

Best For: Long-term appreciation

Median Price: $525,000 | Rental Yield Est: 4-6% | Appreciation: High

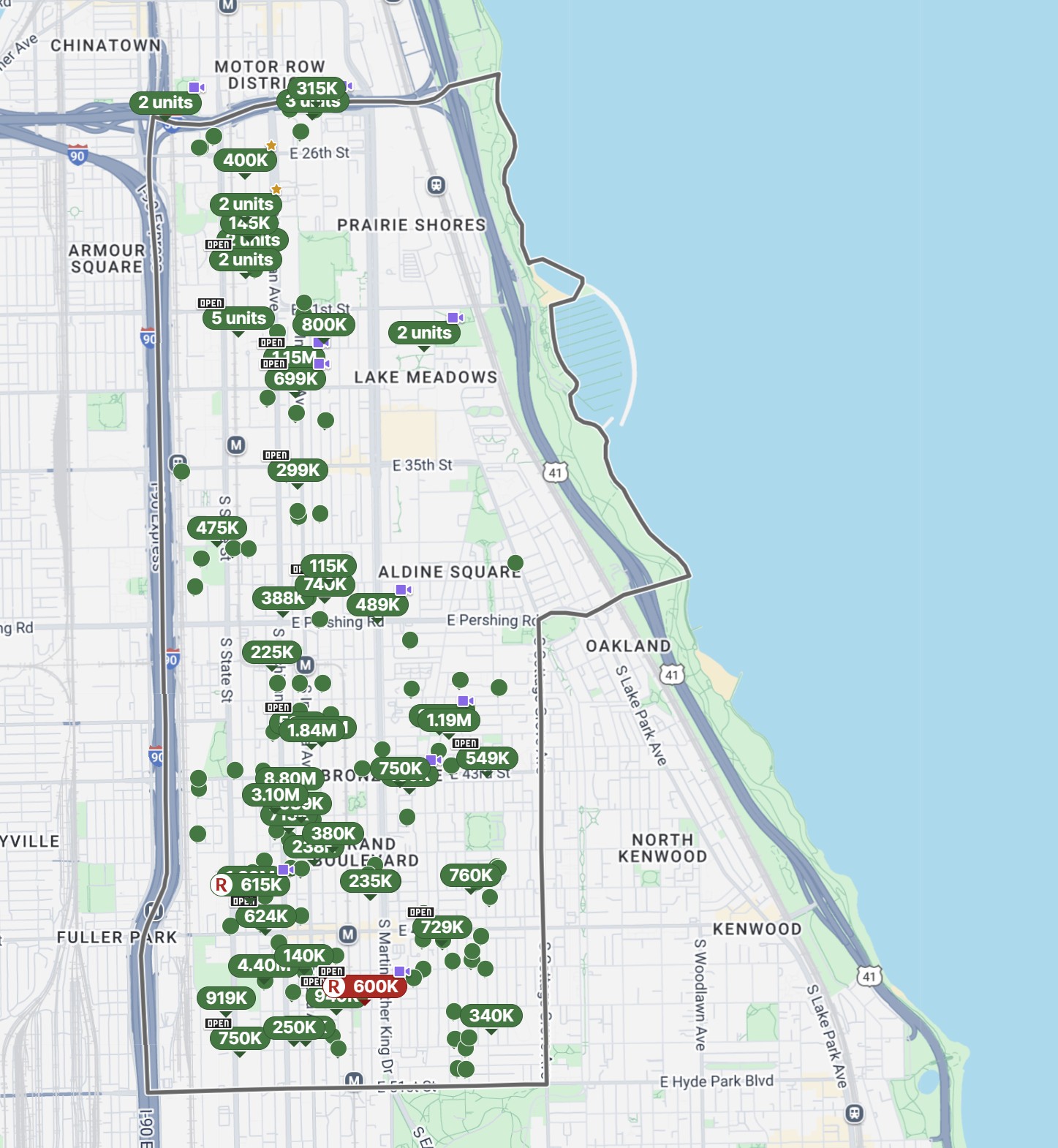

Bronzeville

Best For: Balanced cash flow + growth

Median Price: $280,000 | Rental Yield Est: 7-9% | Appreciation: High

Pilsen

Best For: Aggressive appreciation play

Median Price: $421,455 | Rental Yield Est: 5-7% | Appreciation: Very High

Avondale

Best For: First-time investors

Median Price: $350,000 | Rental Yield Est: 6-8% | Appreciation: Moderate to High

South Shore

Best For: Maximum cash flow

Median Price: $175,000 | Rental Yield Est: 10-12% | Appreciation: Moderate

Humboldt Park

Best For: Value-add opportunities

Median Price: $385,000 | Rental Yield Est: 5-7% | Appreciation: High

Logan Square: The Proven Performer

Logan Square exemplifies successful neighborhood transformation. The challenge is that much of the easy money has already been made. Current investors need to focus on value-add opportunities—properties that can be improved through renovation or better management.

Bronzeville: The Comeback Story

Bronzeville’s renaissance is compelling. This historically significant neighborhood is experiencing renewed investment. The key insight is timing; the neighborhood still offers entry points for new investors. Focus on properties near the Green Line stations.

🏦 Build Your Real Estate Investment Portfolio

Real estate investing requires careful financial planning. M1 Finance offers $75 when you fund an investment account, allowing you to create a “Real Estate Investment” pie with REITs to complement your direct property investments.

Proven Investment Strategies for Chicago Real Estate

Successful Chicago real estate investment isn’t just about picking the right neighborhood—it’s about matching your strategy to market conditions and your personal goals.

The Cash Flow Maximization Strategy

For investors prioritizing immediate returns, target neighborhoods like South Shore and parts of Avondale with multi-unit buildings (2-4 units are ideal for beginners). This strategy works best for those wanting to replace W-2 income, though the trade-off is typically lower appreciation potential.

The Appreciation-Focused Approach

For long-term wealth building, focus on gentrifying areas like Pilsen and Logan Square with single-family homes or condos. This strategy requires more patience and a 5-10 year hold period but can generate significant wealth over time.

Risk Management: What Every Chicago Investor Must Know

Successful real estate investing requires understanding and mitigating risks. Key challenges in Chicago include a significant property tax burden (budget conservatively at 2.5% of purchase price), weather-related maintenance costs, and a tenant-friendly regulatory environment.

Real-World Case Studies

Case Study 1: Logan Square Value-Add Success

- Purchase Price: $400,000 (2022)

- Renovation Investment: $75,000

- Current Estimated Value: $625,000

- Total Return: 37.5% ($150,000 gain)

Lesson: Success in value-add investing requires accurate cost estimation and understanding what local buyers value most. This investor’s background in construction helped control renovation costs.

Case Study 2: Bronzeville Cash Flow Investment

- Purchase Price: $280,000 (2023)

- Net Operating Income: $21,600

- Cash-on-Cash Return: 15.4% (with 50% down payment)

Lesson: Cash flow investing requires active management but can provide excellent returns. Success depends on tenant quality, expense control, and maintaining properties to attract reliable renters.

Financing Your Chicago Investment

Most Chicago real estate investors use conventional investment property loans, which typically require a 20-25% down payment. Maintaining a credit score above 740 is crucial for securing the best interest rates.

Essential Reading for Chicago Real Estate Investors

- The Book on Rental Property Investing by Brandon Turner

- The Millionaire Real Estate Investor by Gary Keller

- What Every Real Estate Investor Needs to Know About Cash Flow

Building Your Investment Foundation

- Emergency reserves: 6-12 months of operating expenses per property

- Credit optimization: Maintain credit scores above 740 for best rates

- Professional team: Establish relationships with investment-friendly lenders

Consider reviewing strategies from successful investors who’ve shared their approaches. The principles outlined in guides about analyzing rental properties and finding the best rental investment cities apply directly to Chicago’s unique market conditions.

Taking Action: Your Path to Chicago Real Estate Success

Chicago’s real estate market in 2024 offers compelling opportunities for strategic investors. The combination of affordable entry points, strong rental demand, and steady appreciation creates an environment where both new and experienced investors can build wealth.

Your Next Steps

- Define your investment criteria: Cash flow vs. appreciation, target neighborhoods, property types.

- Build your team: Real estate agent, property manager, accountant, attorney.

- Secure financing: Get pre-approved and understand your buying power.

Remember that successful real estate investing is a long-term game. Chicago’s market rewards investors who take the time to understand local dynamics, build relationships with reliable professionals, and maintain patience through market cycles.

Trusted Tools & Services

I genuinely use these every day. If you sign up through these links, we both get a win.

Lifestyle & Ridesharing

Finance & Investing

M1 Finance

Get $75 when you sign up and fund a new investment account with $100 or more.

Robinhood

Get fractional shares worth $5-$200 when you sign up and link your bank.

Chase Sapphire Reserve® & Preferred®

Earn 125,000 points with Sapphire Reserve® or 75,000 bonus points with Sapphire Preferred®.

Chase Business Cards

Earn 200,000 bonus points with Sapphire Reserve for Business℠ or up to $1,000 cash back.

Venmo

Both you and your friend earn $5 when they make a qualifying payment of at least $5.

Webull

Join today and get up to 20 free stocks when you fund your account.

Coinbase & Coinbase One

Join Coinbase. Coinbase One members get $10 off next month per referral.

Monarch Money

My favorite tool for tracking all my finances in one place. Try it free for 30 days.

Kalshi

Trade on real-world events. Sign up and we both get $25.