In the vast world of finance, where trillions of dollars flow through the global economy, options trading has emerged as a powerful tool for generating consistent monthly income. With over $200 trillion in derivatives contracts, $6.6 trillion in daily forex transactions, and countless assets traded on exchanges worldwide, the opportunities for profit are immense.

Yet, amid this complex landscape, many investors dive into options trading without fully understanding the mechanics, risks, and strategies involved. In this guide, we’ll explore the intricacies of options trading, from basic concepts to advanced strategies, providing you with the knowledge and tools needed to thrive in any market condition.

Understanding Options

An option is a contract that gives the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) by a specific date (expiration).

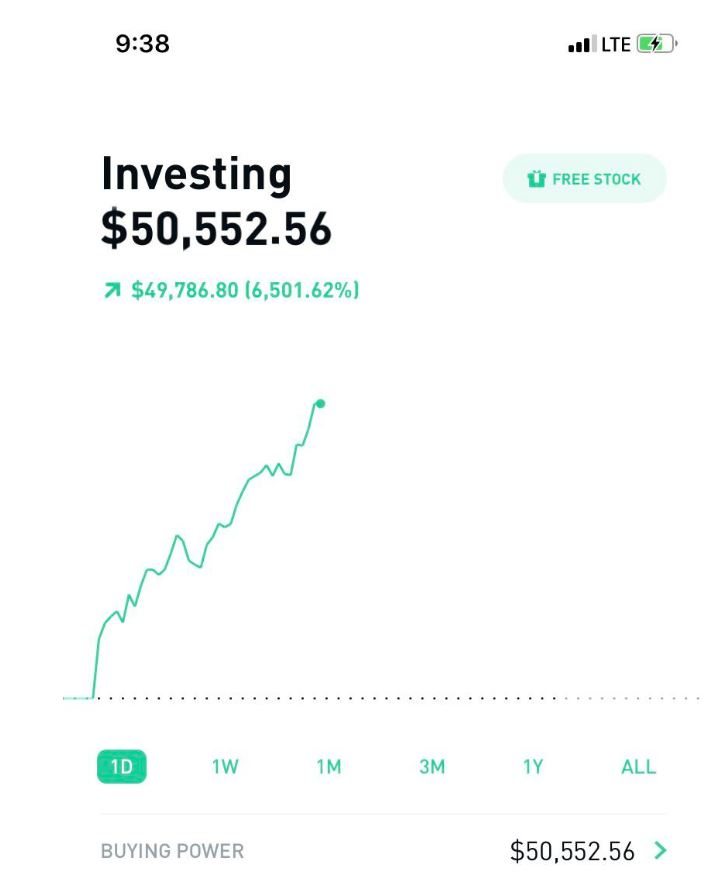

Below is an example of Robinhood’s profit and loss (P/L) chart for call options.

Options trading has the potential to generate massive returns over a very short period of time. However, it also carries an extremely high level of risk that can lead to large losses just as quickly. This post will explore the basics of short-term options strategies that some sophisticated, risk-tolerant traders use in an attempt to make outsized gains.

The first key concept is leverage. Options allow traders to control a large number of shares while only putting up a fraction of the cost of buying those shares outright. This leverage can multiply percentage gains (and losses) compared to just trading the underlying stock.

For example, buying an option giving you the right to purchase 100 shares of a $50 stock for $55 per share may only cost $1 per share or $100 total. If the stock moves up to $60, the option is now worth $5 per share or $500 total – a 400% gain on the $100 premium paid.

Popular short-term strategies include trading weekly options that expire in just a few days, selling credit spreads to collect premium income, and buying debit spreads to risk less than naked options.

For sophisticated traders, there are several scenarios ripe for short-term option plays:

Volatile Markets: When implied volatility spikes, options premiums increase. This allows selling rich premiums through straddles/strangles or spreads looking for a volatility crush.

Earnings Plays: Buying cheap out-of-the-money calls or puts ahead of earnings captures any stock gaps. Alternatively, sell premiums via credit spreads if expecting shares to oscillate.

Upcoming Catalysts: Pending binary events in sectors like biotech or electric vehicles create potential for massive directional moves. Load up on cheap OTM options to leverage any rally.

LEAPS Leverage: Buying deep in-the-money LEAPS calls/puts provides cost-efficient delta exposure with maximum leverage over months.

In all cases, timing entries 4-6 weeks before catalysts while defining strict risk/reward parameters is critical. Laddering positions and hedging through spreads and covered techniques assists with risk management.

While losses can be extreme, deftly trading the highest volatility segments enables potentially making a fortune. But an extremely disciplined approach and active position monitoring is required.

The bottom line is that short-term options strategies are only appropriate for the most sophisticated traders who fully understand and can tolerate the elevated risk. While the upside potential is immense if trades go the right way, the risks of blowing up an account are just as real. Let’s dive deeper.

The price of an option is influenced by several key factors:

Options are classified based on their strike price relative to the current asset price:

- Out-of-the-money (OTM): Call strikes above the current price, put strikes below.

- At-the-money (ATM): Strike price equal to the current asset price.

- In-the-money (ITM): Call strikes below the current price, put strikes above.

Understanding the Greeks and their usage also gives you a significant hedge.

Some Many Strategies

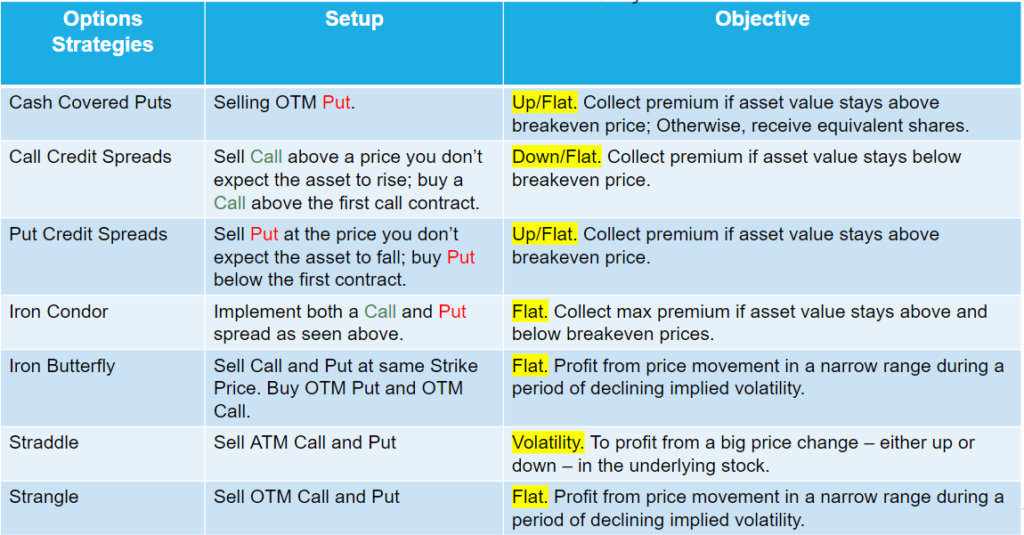

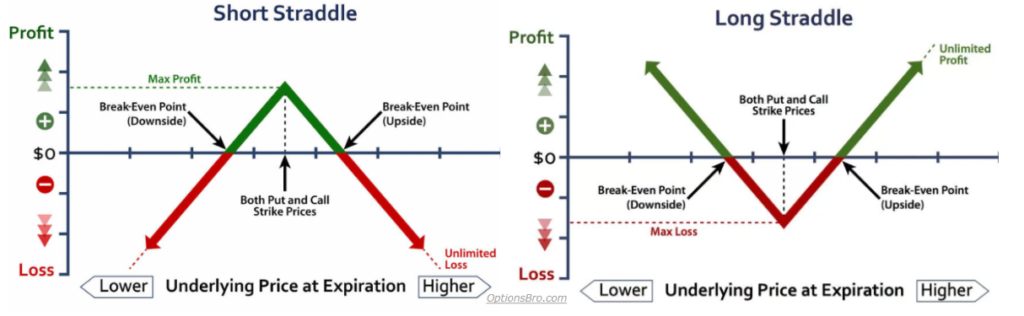

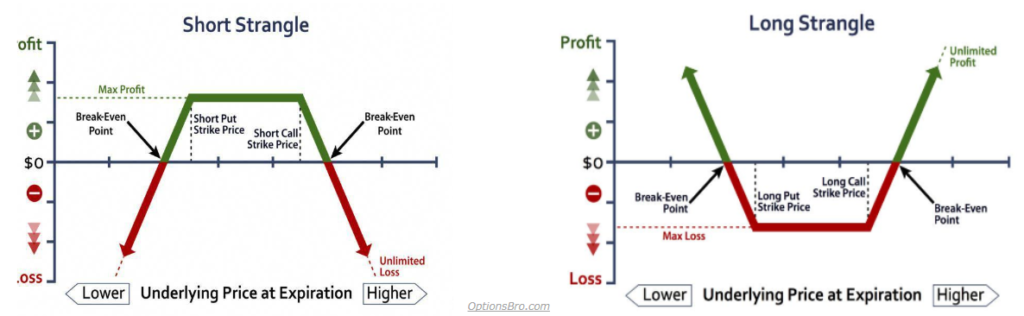

Here is a general overview of the P/L for different Strategies.

But Why!? Below are the objectives of each.

Cash Covered Puts:

- Sell an OTM put to collect premium if the underlying asset stays above the strike price.

- If assigned, you’ll buy shares at the strike price, potentially acquiring stock at a discount.

- Pros: Generate income, potentially acquire stock at a lower price.

- Cons: Limited upside, risk of owning shares if the price falls significantly.

- Best in: Neutral to bullish markets, on assets you wouldn’t mind owning.

Credit Spreads:

- Sell an option and buy a further OTM option to limit risk.

- The width of the spread should be based on your risk tolerance and the options’ deltas.

- A common approach is to sell an option with a delta around 0.30 and buy one with a delta around 0.10-0.20.

Call Credit Spreads:

- Bearish to neutral outlook, profit if the asset stays below the short strike.

Put Credit Spreads:

- Bullish to neutral outlook, profit if the asset stays above the short strike.

- Pros: Limited risk, potentially higher probability of success than naked options.

- Cons: Limited profit potential, risk of total loss if the asset moves beyond the long option strike.

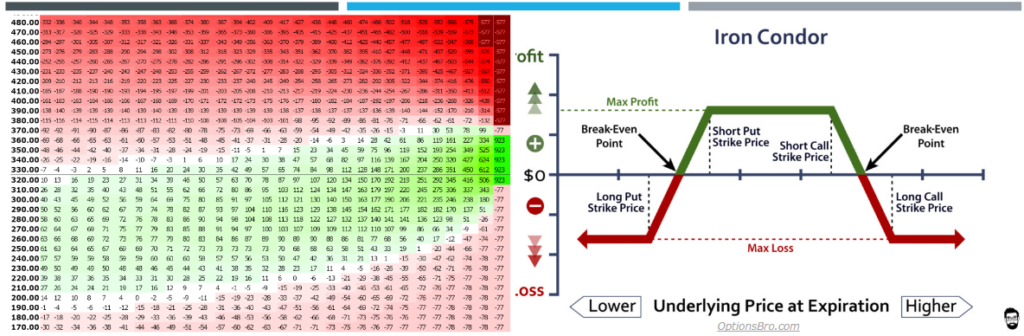

Iron Condor:

- Combine a call credit spread above the current price and a put credit spread below it.

- Profit if the asset remains within a specific range.

- Pros: Profit in neutral markets, defined risk.

- Cons: Potential for significant loss if the asset moves sharply, requires precise strike selection.

- Best in: Low volatility markets, when you expect the asset to trade in a range.

Iron Butterfly:

- Sell an ATM call and put (short straddle) and buy further OTM call and put options (long “wings”).

- Profit if the asset trades in a very narrow range around the central strike.

- Pros: High potential return if the asset stays close to the central strike.

- Cons: Significant risk if the asset moves sharply in either direction.

- Best in: Very low volatility markets, before major events that are expected to have a muted impact.

Volatility Strategies

Straddle:

- Sell an ATM call and put to profit from a significant move in either direction.

- Pros: Profit potential in highly volatile markets.

- Cons: Substantial risk if the asset doesn’t move or if volatility decreases.

- Best in: Before major events expected to cause significant price movement (e.g., earnings reports, product launches, key economic announcements).

Strangle:

- Sell an OTM call and put to profit from the asset staying within the strike prices or from a decrease in implied volatility.

- Pros: Lower risk than a straddle, can profit from a decline in volatility.

- Cons: Requires a larger price move to achieve max profit.

- Best in: Markets with high implied volatility, when you expect a moderate move or a volatility contraction.

Choosing the Right Strategy

Selecting the optimal strategy requires a deep understanding of the underlying asset, current market conditions, and your own risk tolerance and outlook. Utilize tools like options screeners, profit calculators, and probability analyzers to help identify and evaluate potential trades.

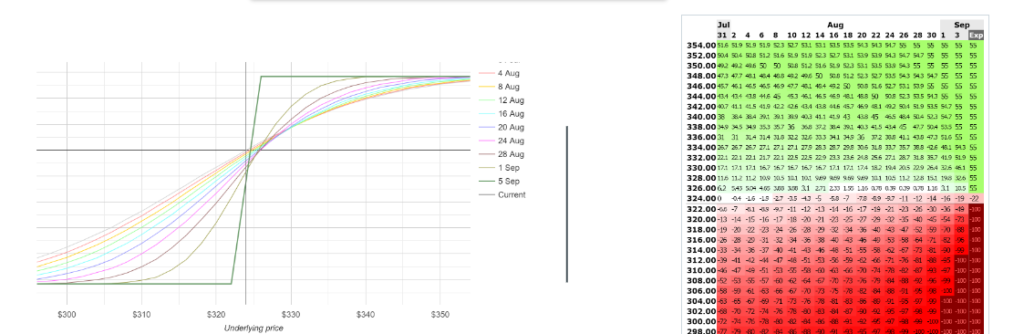

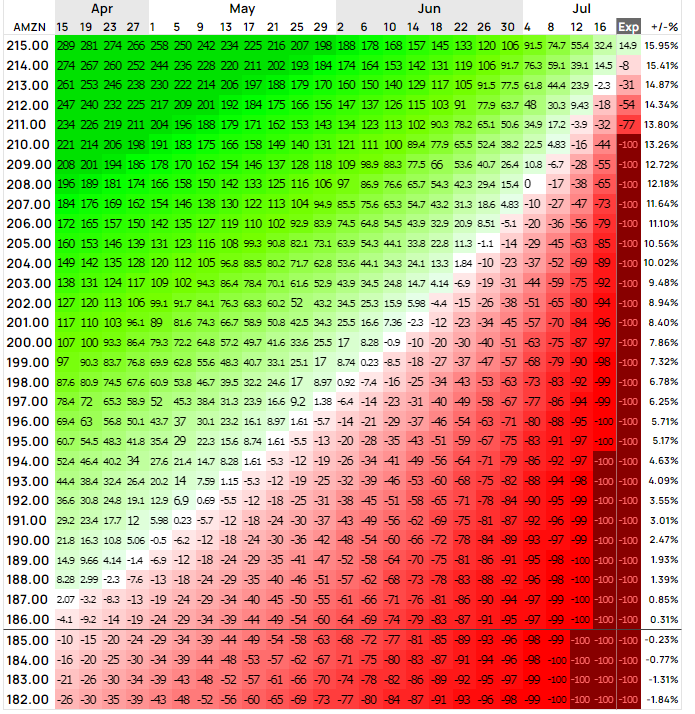

Here is a sample visualizer for Amazon from https://www.optionsprofitcalculator.com/:

We can’t forget implied volatility:

Implied volatility (IV) is a critical factor in options pricing. High IV means options are expensive, favoring selling strategies, while low IV favors buying strategies. Monitor the IV rank and percentile of your options and consider the potential impact of IV changes on your trade.

Best Apps and Tools for Options Trading

tastyworks: User-friendly platform designed for options traders, with a focus on liquidity and execution.

Interactive Brokers: Low-cost broker with a professional-grade platform and global market access.

OptionNet Explorer: Comprehensive options screener and analysis tool.

OptionVue: Integrated platform for options analysis, trade management, and risk assessment.

Robinhood: simple and easy to use, but I suspect that I can get better execution elsewhere.

Risk Management:

Effective risk management is essential for long-term success in options trading. Define your risk tolerance, set clear profit targets and stop-loss levels, and diversify your positions across different underlying, strategies, and expirations. Never risk more than you can afford to lose and continually monitor your positions.

Continuous Education:

Dedicate yourself to continuous learning to stay ahead of the ever-evolving markets. Explore books, courses, webinars, and mentorship opportunities. Engage with trading communities to share ideas and learn from others’ experiences.

You don’t need to be this risky (below). This is a long game. I’ve learned that lesson – it takes one major lost to wipe out gains and confidence. Always understand the risks of any trade. Control position sizing and implement clear proactive risk management plans.

Take Action

Start by paper trading to test your strategies risk-free. As you gain confidence, gradually deploy real capital, starting with small positions. Record your trades in a journal, tracking your thought process, emotions, and outcomes. Regularly review your performance and adapt your approach as needed.

Remember, success in options trading requires discipline, patience, and continuous improvement. Embrace the challenges, learn from your mistakes, and stay focused on your long-term goals.

Resources

- “Option Volatility and Pricing” by Sheldon Natenberg

- “Options as a Strategic Investment” by Lawrence G. McMillan

- tastytrade’s “Where Do I Start?” educational series

- The Options Industry Council’s “Options Strategies” guide

By mastering options trading, you can unlock a powerful tool for generating consistent monthly income and thriving in any market condition. Start your journey today, and may the odds be ever in your favor!