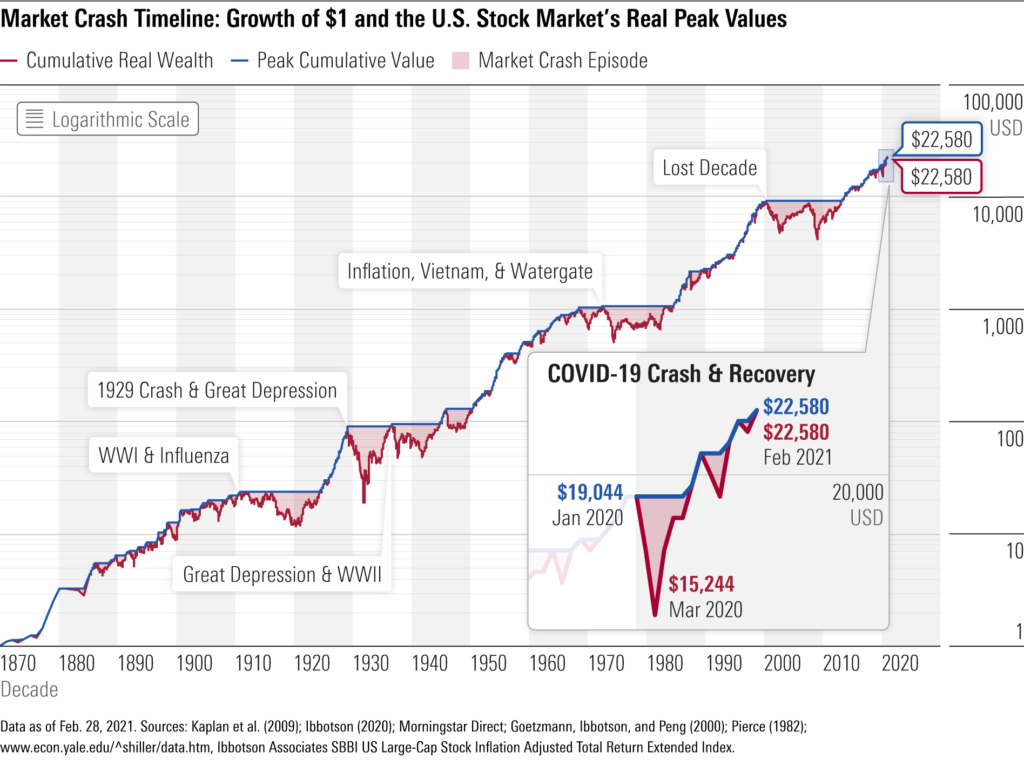

As a seasoned investor with a decade of experience navigating the ever-changing landscape of finance, I’ve seen my fair share of market ups and downs. For the past six years, I’ve been diligently contributing to my traditional IRA through M1 Finance, a platform that offers a wide array of investment options. While my portfolio had its moments, it was nothing to write home about – until the pandemic’s initial hit. I clearly remember walking through the snow for a trip and wondering if I should sell in March 2020.

Like many investors, I found myself drawn into the meme stock mania of the early pandemic days. The allure of quick gains and the hype around WallStreetBets proved too tempting to resist. I watched as stocks like GameStop (GME) and AMC Entertainment (AMC) soared to unbelievable heights, fueled by a mix of retail investor enthusiasm and a desire to stick it to the short-selling hedge funds.

In a moment of weakness, I decided to allocate a portion of my IRA to these volatile meme stocks. The FOMO was real, and I convinced myself that I could ride the wave to the moon 💎🚀🌚. Oh, how naive I was. It wasn’t as bad as this so I slept fine…

As the meme stock bubble began to burst, my portfolio took a severe hit. By the end of 2020, I had lost a good portion of my IRA’s value – the amount is strictly confidential and subject to attorney-client privileges. It was a lesson in the dangers of chasing hype and neglecting fundamental analysis.

Licking my wounds, I decided to adopt a more conservative approach immediately. I constructed a 5 ETF portfolio, focusing on broad market exposure and safe boring diversification.

- 50% VTI (Vanguard Total Stock Market ETF),

- 25% VXUS (Vanguard Total International Stock ETF),

- 10% BND (Vanguard Total Bond Market ETF),

- 5% BNDX (Vanguard Total International Bond ETF),

- and 10% VNQ (Vanguard Real Estate ETF

While this strategy provided some stability, it felt like watching paint dry. My IRA was merely treading water, and I yearned for something more.

That’s when the news of Bitcoin ETFs approval caught my attention. As a long-time follower of the cryptocurrency space, I understood the significance of this development. The ability to gain exposure to Bitcoin through a regulated, traditional investment vehicle was a game-changer.

Without hesitation, I allocated my entire IRA to the Fidelity Advantage Bitcoin ETF (FBTC) on M1 Finance the day it became available. The results were nothing short of astounding. As Bitcoin’s price surged, my IRA began to recover, and then some. The crypto allocation acted as a portfolio savior, helping me not only recoup my meme stock losses but also propel my IRA to new heights.

However, the crypto market’s volatility is not for the faint of heart. The wild price swings, often triggered by tweets from influencers like Elon Musk or regulatory rumblings, served as a constant reminder of the risks involved. It was a thrilling ride, but one that required a strong stomach, a long-term perspective, faith, and hope…

As my IRA reached new milestones, I decided to take some profits off the table and rebalance my portfolio. I shifted a portion of my gains back into my tried-and-true ETF lineup, embracing the wisdom of diversification and risk management. And then recently, I removed the Bitcoin ETF entirely since I have separate direct crypto holdings elsewhere. Below is the new boring IRA investment breakdown to combat 2024 uncertainty, for now.

Looking back, my journey from meme stock mayhem to Bitcoin bliss taught me valuable lessons. The importance of due diligence, the power of patience, and the necessity of adapting to changing market conditions. The traditional IRA, often seen as a bastion of slow and steady investing, can benefit from a measured dose of innovation and calculated risk-taking.

If you’re considering dipping your toes into the world of crypto or exploring new investment opportunities within your IRA, M1 Finance provides a user-friendly platform to do so. And if you decide to join, using my referral link can give you a little extra boost to kickstart your investing journey:

https://m1.finance/CS1v5SJcFDLa

(M1 gives you up to $75 just for signing up with this link! You can Invest, borrow, save, and spend in one place, with awesome custom automation. This has become my core personal finance automation tool.)

Of course, it’s crucial to remember that my experience is not a prescription for success. Every investor’s situation is unique, and what worked for me may not be appropriate for everyone. As with any investment, it’s essential to conduct your own research, understand your risk tolerance, or and make informed decisions based on your financial goals.

In the end, my IRA’s wild ride from meme stock catastrophe to Bitcoin redemption has only reinforced my belief in the power of diversification, the importance of staying informed, and the potential for unconventional assets to shape the future of investing. So, as you navigate your own investment journey, remember to keep an open mind, stay curious, and never stop learning. The world of finance is an ever-evolving landscape, and those who adapt are the ones who will ultimately thrive.

Happy investing, and may your IRA adventures be as exciting (and hopefully less stressful) than mine!